Best Broker For Forex Trading Fundamentals Explained

Best Broker For Forex Trading Fundamentals Explained

Blog Article

Best Broker For Forex Trading Fundamentals Explained

Table of ContentsThe Greatest Guide To Best Broker For Forex TradingThe 8-Second Trick For Best Broker For Forex TradingThe Ultimate Guide To Best Broker For Forex TradingWhat Does Best Broker For Forex Trading Mean?Not known Facts About Best Broker For Forex Trading

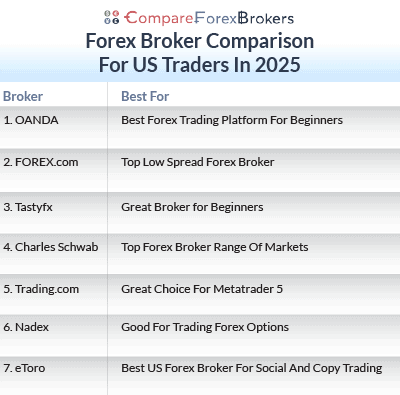

You ought to consider whether you can afford to take the high risk of shedding your cash. In summary, it is hoped that you currently have the required understanding to discover an on the internet forex broker that fulfills your demands. Whether it is regulation, trading costs, deposits and withdrawals, customer support, trading devices, or the spread you currently understand what to watch out for when choosing a new system.If you do not have the time to study systems yourself, it may be worth exploring the top 5 suggested foreign exchange brokers that we have actually reviewed above. Each foreign exchange broker masters a specific division, such as reduced costs, mobile trading, user-friendliness, or depend on. Inevitably, simply ensure that you comprehend the risks of trading foreign exchange online.

This means that significant foreign exchange sets are covered to utilize levels of 30:1, and minors/exotics at 20:1. If you are an expert investor, these limitations can go right up to 500:1 on majors. While minimum down payments will certainly differ from broker-to-broker, this commonly standards 100 in the UK. If the broker is based in the UK, after that it needs to be regulated by the FCA.

With such a large market, there will be constantly someone ready to buy or offer any kind of currency at the priced quote cost, making it easy to open up and shut professions or transactions at any time of the day. Nevertheless, there are durations of high volatility throughout which it may be not very easy to obtain a good fill.

The Buzz on Best Broker For Forex Trading

But as any various other market, during durations of instability slippage is constantly a possibility. Greater liquidity additionally makes it difficult to manipulate the marketplace in an extended fashion. If a few of its individuals attempt to control it, the participants would need enormous amounts of cash (tens of billions) making it practically impossible.

We will certainly speak about this in the future. The Foreign exchange market is an all the time market. Best Broker For Forex Trading. This suggests that you might open up or close any type of position at any kind of time from Sunday 5:00 pm EST (Eastern Standard Time) when New Zealand starts procedures to Friday 5:00 pm EST, when San Francisco ends operations

Some brokers offer up to 400:1 take advantage of, implying that you can control for instance a 100,000 United States buck deal with simply.25% or US$ 250. If the take advantage of is not correctly used, this might additionally be a negative aspect.

We will certainly go deeper in to this in the following lesson Because of this, utilizing take advantage of above 50:1 is not recommended. Remember: the margin is used as a down payment; whatever else is also in danger. The Forex market is considered among the marketplaces with the lowest prices of trading.

Top Guidelines Of Best Broker For Forex Trading

There are 2 crucial players you can not bypass in the foreign exchange (FX) market, the liquidity companies and brokers. While brokers link traders to liquidity suppliers and carry out trades on behalf of the traders.

Brokers are people or business that stand for traders to purchase and market possessions. Every broker needs to obtain a permit.

Best Broker For Forex Trading Fundamentals Explained

After the parties concur, the broker forwards the LP's offer to the trader. As soon as the rate and terms are sufficient, the trade is performed, and the asset is relocated. To summarize the symbiotic dancing, each celebration take their share of the gained cost. Online brokers charge the investor a payment while LPs gain earnings when they buy or offer properties at profitable prices.

We have actually given three examples to show find here the cooperation between these celebrations. Digital Communication Networks (ECNs) link investors to numerous LPs, they use competitive rates and transparent implementation. Below the broker itself functions as the LP, in this model, the broker takes the opposite side of the profession. This model proposes faster implementation nevertheless, it increases possible conflicts of rate of interest.

When both celebrations are on the very same page, the connection between the 2 is typically beneficial. A partnership with LPs makes it much easier for brokers to satisfy different profession propositions, generating more customers and improving their company. When online brokers access multiple LPs, they can offer competitive prices to investors which enhances boosted consumer fulfillment and commitment.

Not known Incorrect Statements About Best Broker For Forex Trading

Allow's study the vital see this site areas where this collaboration radiates. This partnership aids to increase the broker's funding base and allows them to offer larger trade sizes and satisfy institutional clients with significant financial investment needs. It additionally expands LPs' reach with validated broker networks, hereby giving the LPs access to a bigger pool of prospective clients.

Report this page